In recent months, many EU member states published their draft DAC7 rules. This is in preparation for the legal transposition deadline of December 31, 2022. Our update summarizes the current status of implementation across the EU.

DAC7 is a new data sharing obligation that applies to digital platforms enabling users to:

- Sell goods eg. Amazon, eBay

- Rent out immovable property eg. Airbnb, Booking.com

- Carry out personal services eg. Uber, TaskRabbit

- Rent any mode of transport eg. Turo, Click & Boat

Digital platforms affected by DAC7 are already putting their processes in place.

This initiative impacts platforms of all sizes.

Within the DAC7 directive, users who sell goods or provide services through digital platforms are referred to as ‘sellers’. This new rule means that if you are affected you should validate and share your sellers’ data with country tax authorities, including:

- Name

- Address

- Tax ID

- Bank account number

- Annual earnings made through your platform

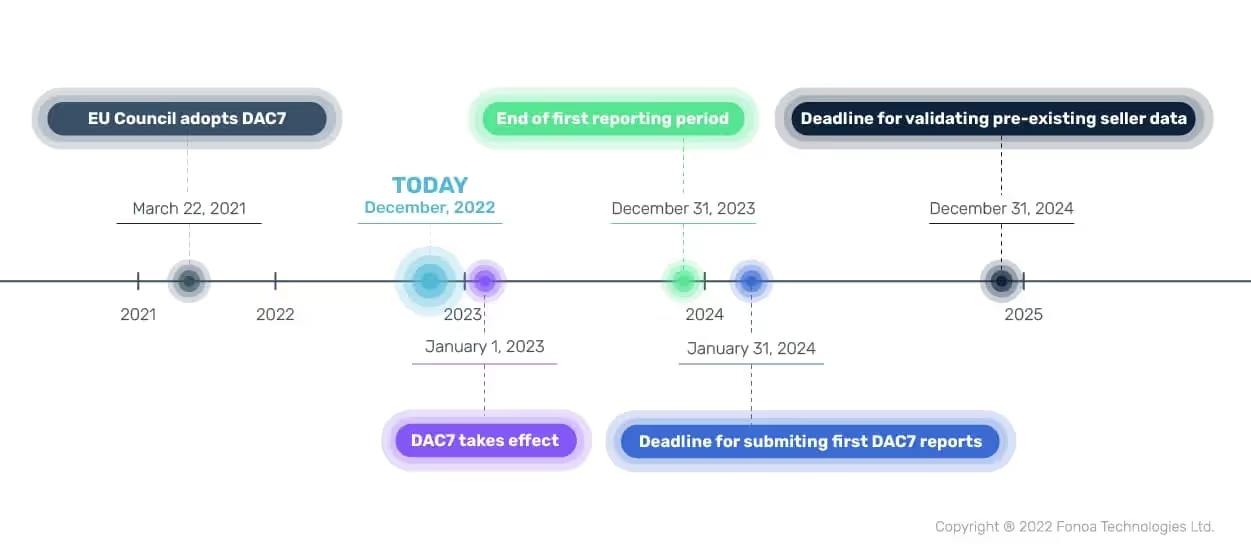

Timeline

On March 22, 2021, the European Council adopted DAC7. It ordered EU members to fully implement the directive into national law by December 31, 2022. Of course, this is at national government level.

At business level your first DAC7 reports must be submitted by January 31, 2024. Seems like that’s a ‘next year’ problem, doesn’t it? But to make sure you’re fully DAC7 compliant, you need to prepare now.

That first report is based on your 2023 sellers’ data. So digital platforms need to collect, backfill, and validate all the required information now.

The data validation of pre-existing sellers needs to be finished by December 31, 2024.

Country status update

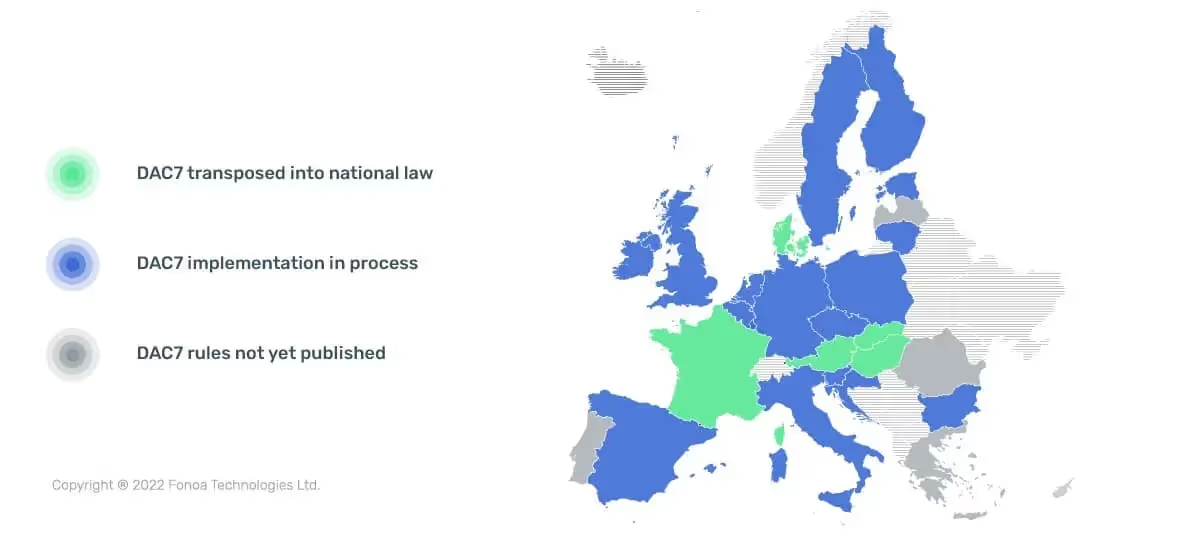

We can see an increase in activity this fall with multiple countries making significant progress towards the implementation of DAC7 by either starting public consultations, publishing draft legislation or in the case of Austria and Slovakia transposing DAC7 into national law.

The map below shows the current status of implementation across Europe. You can find out more details about individual countries through the links at the end of the article.

🇦🇹Austria: Legislation updated July 20, 2022

🇩🇰Denmark: Legislation, updated September 6, 2022

🇫🇷France: Legislation, updated 1 April 2022

🇭🇺Hungary: Legislation, updated November 4, 2022 (NEW UPDATE!)

🇸🇰Slovakia: Legislation, updated 15 June 2022

🇧🇬Bulgaria: Official source, updated November 11, 2022

🇭🇷Croatia: Official source, updated September 1, 2022

🇨🇿Czechia: Official source, updated September 30, 2022

🇪🇪Estonia: Official source, updated October 24, 2022

🇫🇮Finland: Official source, updated October 21, 2022

🇩🇪Germany: Official source, updated August 26, 2022

🇮🇪Ireland: Official source, updated October 20, 2022

🇮🇹Italy: Official source, updated September 10, 2022

🇱🇹Lithuania: Official source, updated September 7, 2022

🇱🇺Luxembourg: Official source, updated October 21, 2022

🇳🇱Netherlands: Official source, updated July 30, 2022

🇵🇱Poland: Official source, updated October 28, 2022 (NEW UPDATE!)

🇸🇮Slovenia: Official source, updated August 1, 2022

🇪🇸Spain: Official source, updated February 22, 2022

🇸🇪Sweden Official source, updated November 8, 2022 (NEW UPDATE!)

🇬🇧UK*: Official source, updated October 18, 2022 *not in the EU, but will likely introduce a compatible data sharing regime

🇨🇾Cyprus

🇬🇷Greece

🇱🇻Latvia

🇲🇹Malta

🇵🇹Portugal

🇷🇴Romania

Check back monthly for updates!

How can Fonoa help?

In less than 2 months DAC7 will take effect across the EU. Platforms will not only have to start collecting all required data points from new sellers, but will also need to collect and validate data of their pre-existing sellers.

With our tax number validator, you can validate tax IDs from 96 countries in bulk and individually, and return necessary information from local databases like company name and address.

When DAC7 is in place, our Data Sharing product will guide tax professionals towards compliance and automate technical complexities so you can save time while owning and controlling the end-to-end process

Put your time and energy back into your business, not tax compliance. Get in touch to automate these Data Sharing and DAC7 compliance processes.