Many countries tried to stimulate their ailing economies during the Covid lockdowns of early 2020, but few went as far as Colombia. The Colombian government designated days when consumers could buy certain goods without paying Value Added Tax (VAT).

VAT increases the price of goods much like its United States equivalent, sales tax. Unlike sales tax, VAT gets charged at every step of production and is included in an item’s sticker price.

How do Colombia’s Tax-Free Days work?

The VAT holidays apply to specific consumer goods throughout the country, most of which get taxed at 19%. “Basically, it’s almost a 19% discount on these goods, which the Government hopes is significant enough to push people to buy things,” says Jonthe Grotenhuis, Tax Technology Manager at Fonoa and a VAT Specialist. In shops an item’s sticker price includes VAT, so the price the consumer sees on the shelf will reflect the tax-free day. “This makes the mental impact of the VAT holiday even greater,” according to Jonthe.

The Colombian government has set maximum prices for the VAT holiday based on the product type. These prices are set in Unidad de Valor Tributario, or UVT. Each UVT equals a certain number of Colombian pesos — 38,004 in 2022 — and increases yearly based on inflation. “It’s a smart way of dealing with inflation while keeping the law understandable,” Jonthe notes. “With inflation continuing to soar in 2022, the adjustment next year could be quite significant.”

Which goods do VAT Holidays apply to?

Colombia’s tax-free days apply to the following goods:

- Clothing and shoes (max. 20 UVT)

- Clothing accessories (max. 20 UVT)

- Home goods, computers, and communication equipment (max. 80 UVT)

- Sporting goods (max. 80 UVT)

- Toys and games (max. 10 UVT)

- School supplies (max. 5 UVT)

- Goods for the agricultural sector (max. 80 UVT)

For example, clothing priced at 760,080 Colombian pesos — about $170 — or less qualifies for the 2022 VAT exemption (20 UVT max for clothing * 38,004 2022 UVT value = 760,080 pesos).

What effects do the Tax-Free Days have?

Like all of his teammates at Fonoa, Jonthe works remotely, which gave him a unique opportunity to see the public reaction to the tax-free days. “Even in the Colombian jungle I was camping in at the time, the VAT holiday had an impact,” Jonthe says. “One person staying at a nearby campsite sold clothes online. She had to leave camp early that morning and stay up past midnight preparing orders.”

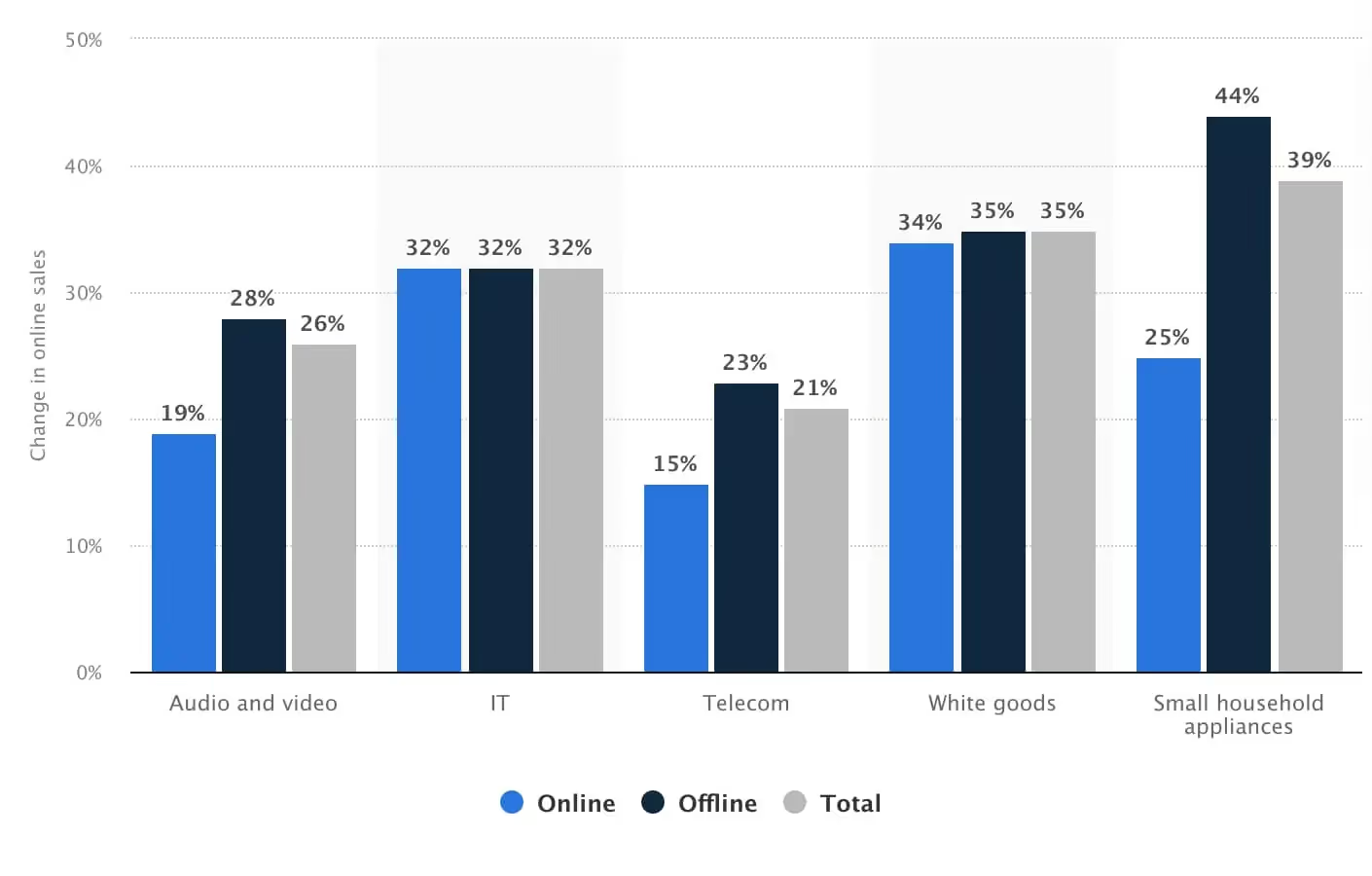

The statistics show that frenzied sales on tax-free days have become the norm. On the first VAT-free day of 2022, sales of exempt goods rose significantly as shown in the following chart:

Source: Statista 2022

Critics say that VAT holidays lead to lower spending on other days, but Jonthe’s contact disagrees: “She said people always need clothes and won’t necessarily wait until a specific day.”

The popularity of Colombia’s tax-free days might prove their biggest downside. The government held three VAT holidays in 2020 to aid the Covid-battered economy: two in summer and one near Christmas. “In 2020, I don’t think the government intended to do the tax-free days on a yearly basis, but that’s what happened. Few politicians want to oppose a very popular measure,” says Jonthe. While not yet a permanent part of Colombian law, three VAT holidays were also held in 2021 and 2022, with more planned for next year.

What compliance issues do VAT Holidays create for companies?

The Colombian Tax Authorities (DIAN) impose strict conditions on vendors supplying VAT-free goods. Most significantly, vendors must store the ID number of the buyer, issue an e-invoice, and submit the e-invoice to the Colombian Tax Authorities within 15 days.

Jonthe helps companies comply with often-complex indirect tax laws. “It’s challenging to build tax solutions globally. The complexity makes it interesting; we make it simple for our clients,” Jonthe says, noting how global challenges require a global team. Using our global experience, we are able to predict potential issues in various markets and build our products accordingly. Fonoa's tools allow a huge amount of flexibility. If you need to change your invoicing quickly our tool allows you to do that. If you use our tax engine and you need to change a rate, it's super easy - we don't do goods yet of course but I think the Colombia is a good general demonstration of how that flexibility is beneficial.

As an added bonus, “Allowing employees to work 100% remotely makes it easier for Fonoa to recruit the best talent from around the world. We have a great team at Fonoa, with people from diverse cultural backgrounds.”

Additional Resources: