Welcome to the world of tax automation

Retain customers and expand into new markets with a single platform for fully compliant tax workflows.

See how Fonoa can help you

See how Fonoa can help youThe digital economy is thriving, with new business models that truly transcend borders and change global commerce.

Ever-changing tax regulations

Yet a hidden burden falls on corporate tax leaders and their teams—the way online transactions are taxed has become so complicated and ephemeral that tried-and-true tax management workflows are all but obsolete. When founder Davor Tremac was a general manager at Uber, he saw firsthand how changing tax requirements and regulations curbed expansion in many markets.

They were growing faster than local governments could decide on tax liability or gain any visibility into transaction data, leaving a complex web of regional tax and reporting rules for Tremac’s team to navigate manually.

We are here to help online businesses stay tax compliant while scaling globally

There was a glaring need that could only be fulfilled with real-time data, and Fonoa became the solution. As the only platform that can streamline and automate real-time tax workflows across so many countries and local governments in one place, Fonoa helps tax managers manage their obligations without the stress. The global tax landscape won’t get simpler, but that’s ok—we’re here to make it simple for you.

Meet our team

Leadership team that makes Fonoa amazing

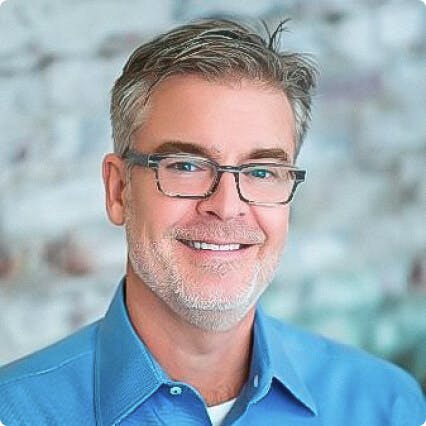

Davor Tremac

Chief Executive Officer & Co-Founder

Filip Sturman

Chief Product Officer & Co-Founder

Shane Kent

Chief Revenue Officer

Kristen Souki

Chief People Officer

Pablo Carranza

Chief Technology Officer

Rob van der Woude

Chief Tax Officer

Join our team

We’re a fully distributed, fast-growing company that’s tackling one of the biggest problems in global commerce. We already have team members in more than 25 countries across the world — join us from wherever you are!

Fonoa’s product suite

Fonoa products seamlessly integrate with your enterprise systems through a simple set of APIs. See how they all work in unison for stress-free global tax workflows.

Lookup instantly validates tax ID numbers

Explore LookupTax determines tax rates of each transaction

Explore TaxInvoicing issues locally compliant invoices

Explore InvoicingE-invoicing sends authorities tax data in real time

Explore E-invoicingReturns files correctly with local governments

Explore ReturnsData Sharing ensures your compliance with DAC7

Explore Data Sharing