Secure & compliant tax data sharing

Meet quickly evolving tax information reporting obligations and securely share tax data with authorities across countries.

Let’s talk

Trusted by the world’s leading companies

Complying with tax information reporting rules is not easy

Many countries are introducing tax information reporting rules that require digital platforms to share information about their sellers electronically. This creates technical complexity that is hard to manage.

Why use Fonoa?

Automate technicalities and get guidance through the entire reporting process.

All your file preparations and submissions available in a single place.

Connect directly to local tax authorities making tax information reporting effortless.

Fonoa’s solution will help you comply with local and regional transparency laws with built-in configurations for data sharing with tax authorities in real time

Comply automatically with:

DAC7 in the EU

HMRC's Reporting Rules for Digital Platforms in the UK

Part XX information returns in Canada

SERR in Australia, or

Digital platform information disclosures in New Zealand

Compliance through a single platform

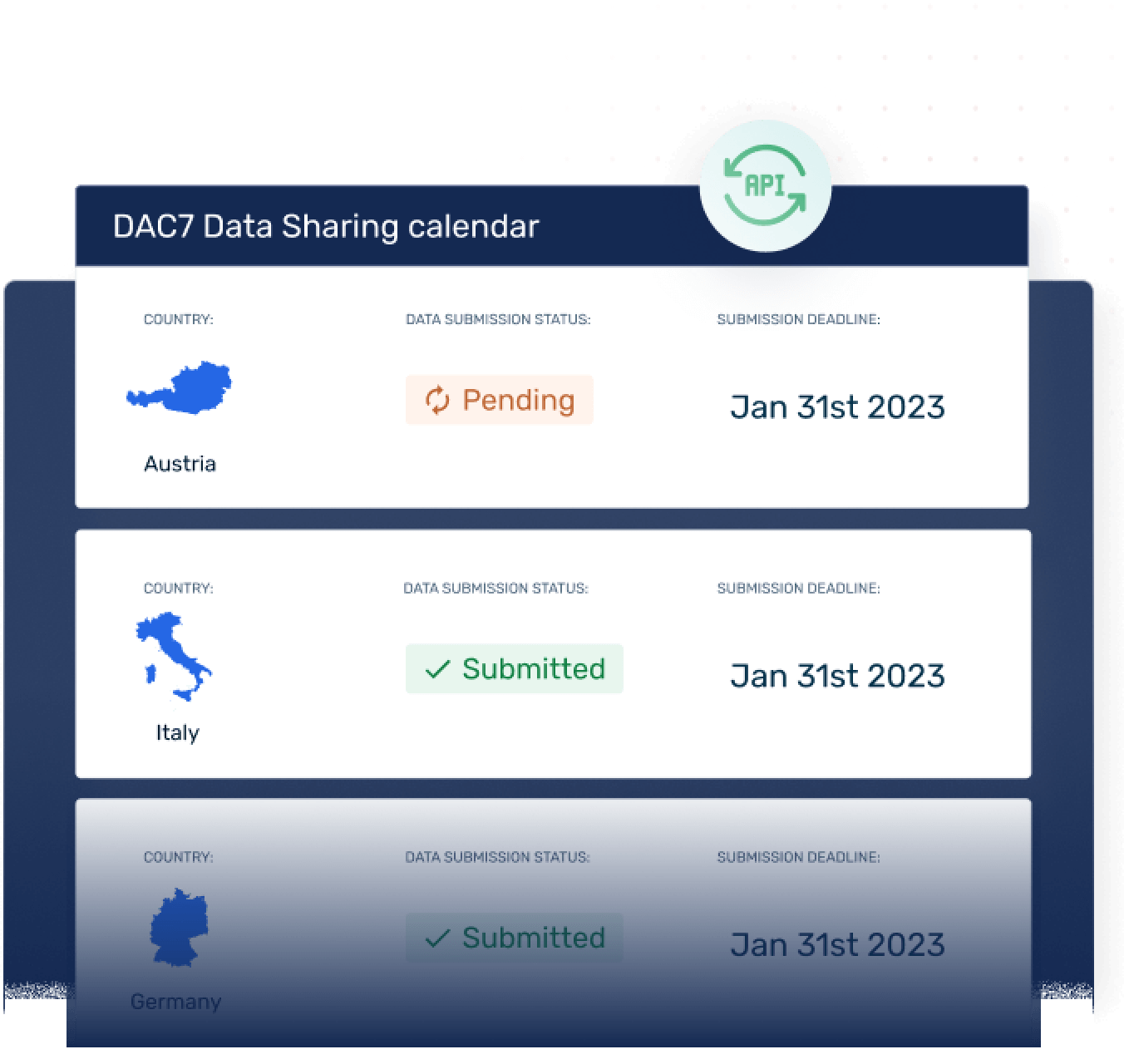

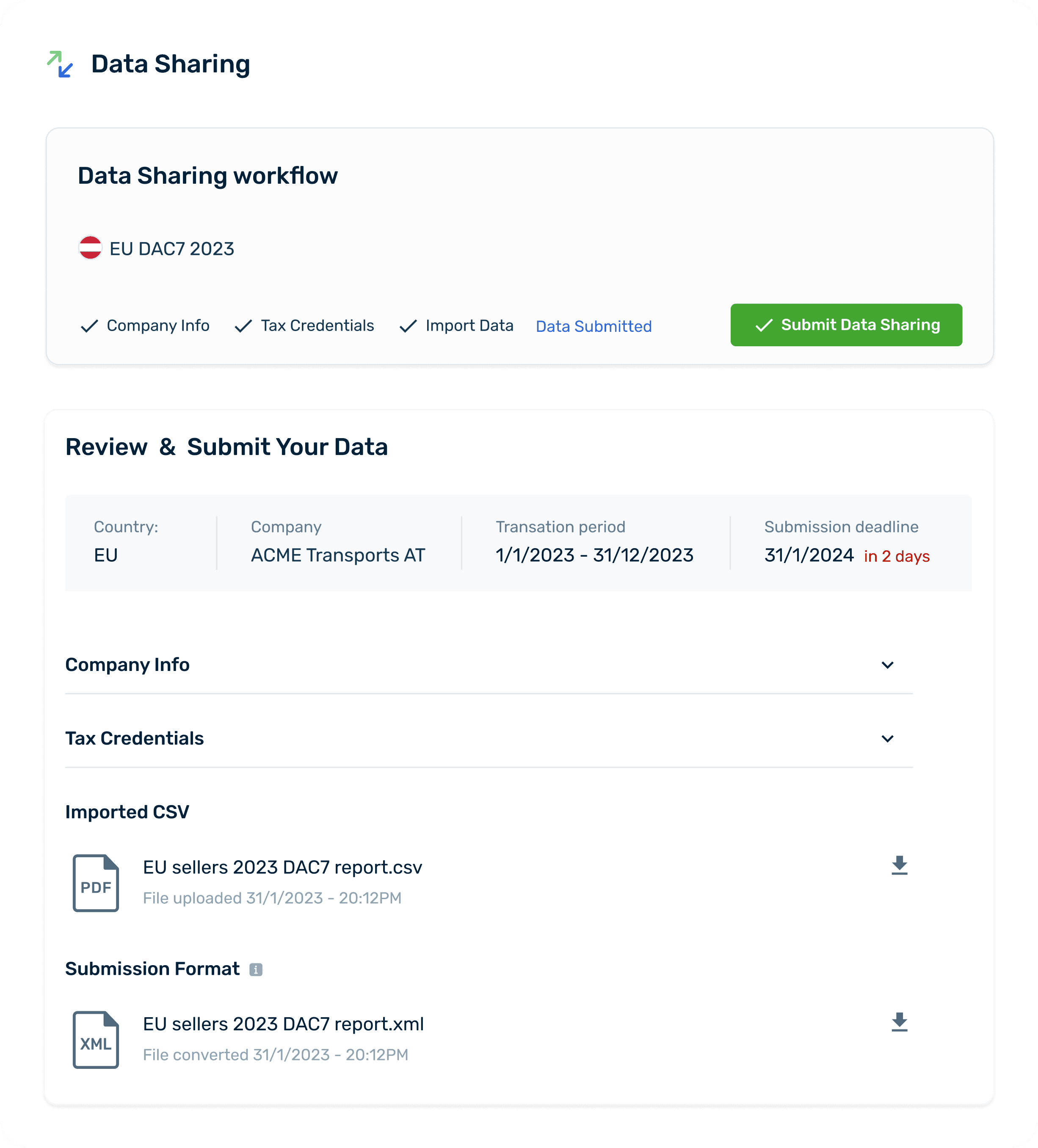

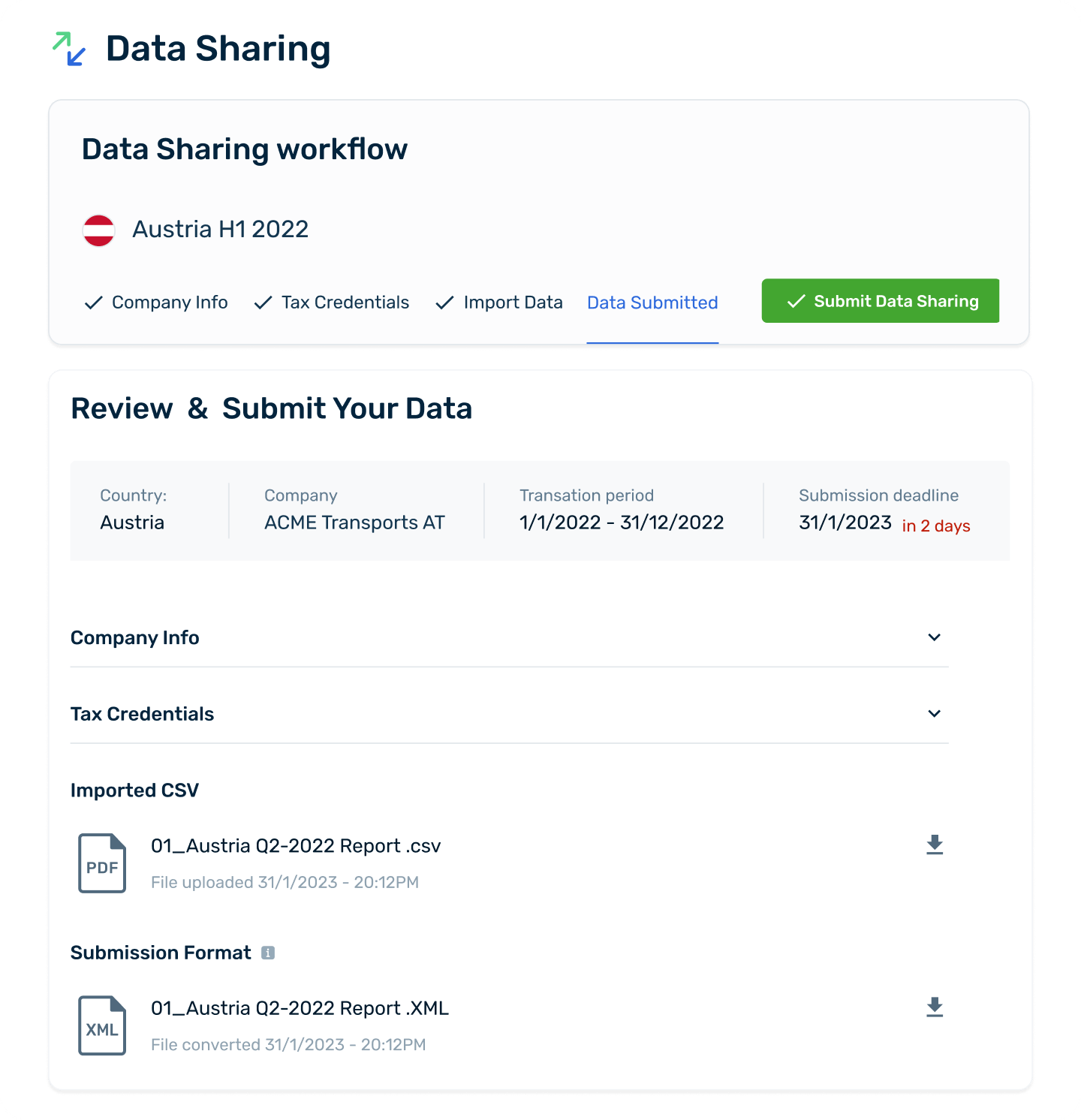

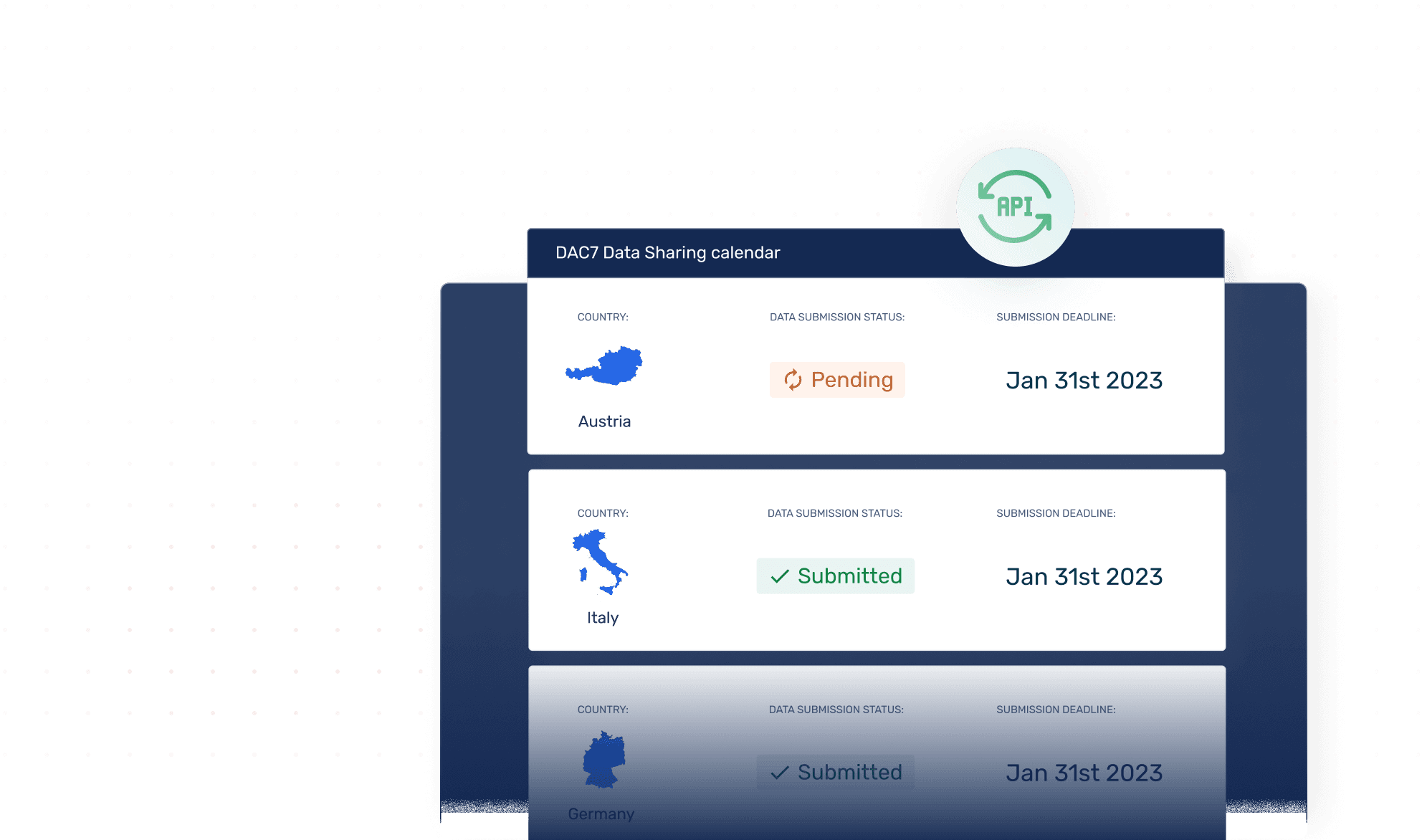

Our Data Sharing platform simplifies the compliance process and automates technical complexities so you can save time while controlling the end-to-end process.

Regional tax laws

Comply with tax information reporting rules in the EU, Canada, Australia, New Zealand and the United Kingdom.

Automate data sharing

Automatically share platform seller data with authorities, including tax IDs, contact info, and industry-specific details.

Avoid fines and pass audits

Avoid heavy fines and pass audits by maintaining a single source of truth of transaction and reporting histories.

Track legislation globally

Stay on top of global data sharing obligations and their unique requirements.

Automate technical complexities

Automate technical complexities such as government reporting connections, data operations, and information validation.

Save time

Save time and own the end-to-end data sharing process.

Fonoa’s Data Sharing solution was pivotal in helping us resolve

the compliance challenge known as DAC7. Fonoa’s in-house tax

and engineering team helped us bridge the technical gap of

connecting to tax authorities.