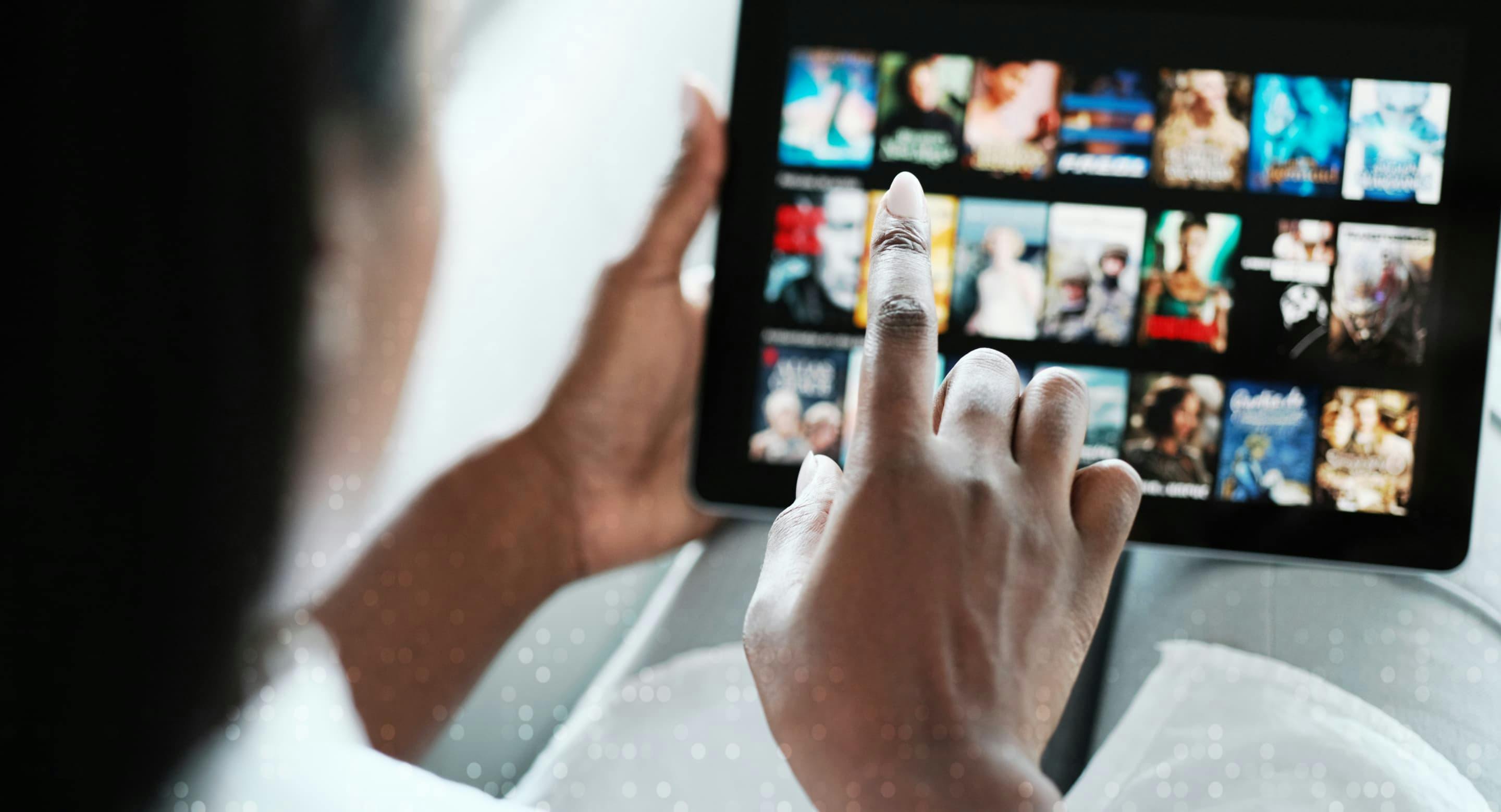

Tax automation for digital content providers

Calculate and charge the right taxes on music, video, elearning, and other digital content according to local regulations in over 100 countries.

Let's talkOne solution to comply with tax rules for digital content globally

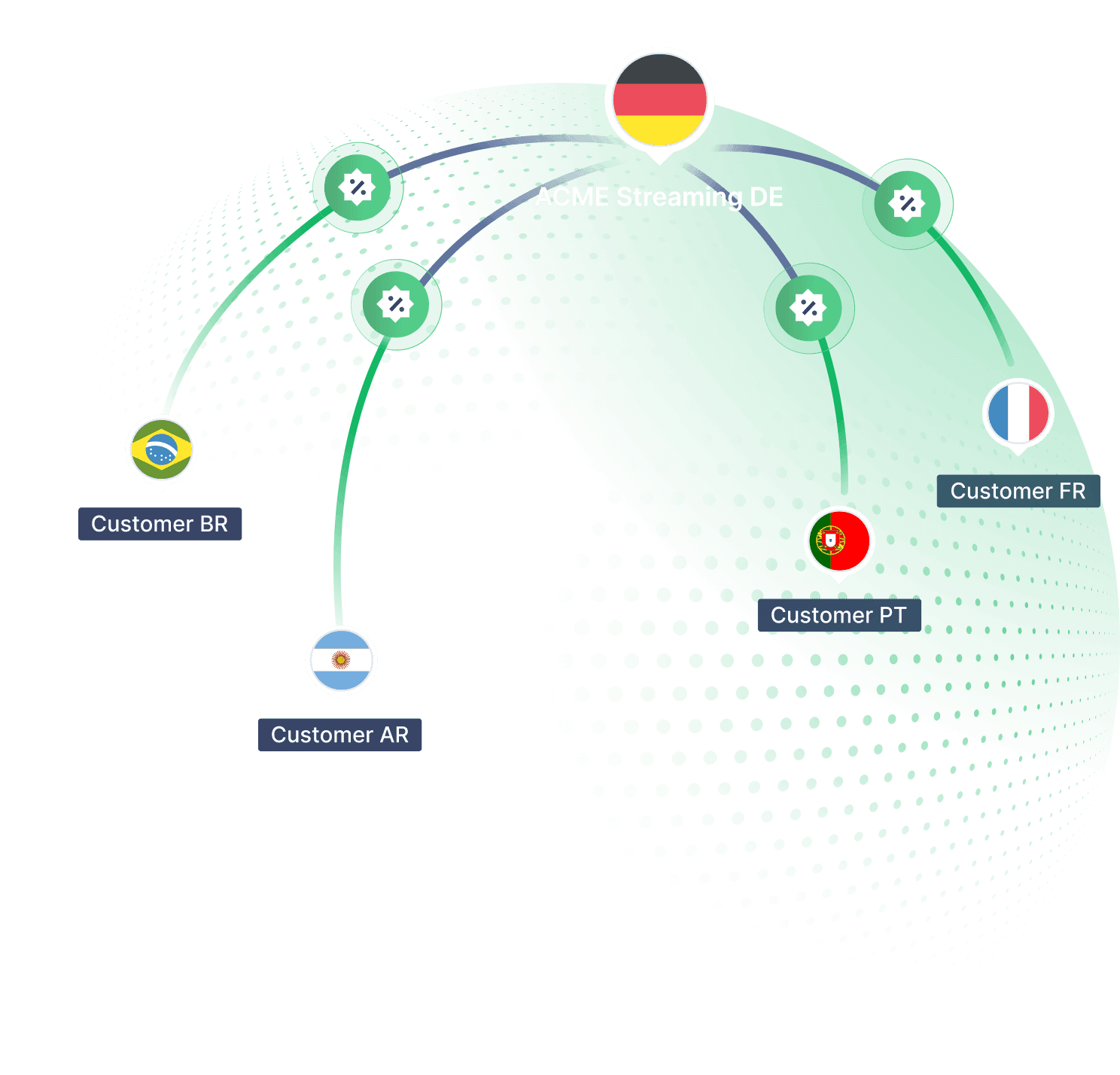

Digital content providers attract a diverse audience in terms of their locations and tax status - creating a challenge for finance and tax teams globally. With Fonoa, you can easily monitor your sales with over 100 local VAT/GST registration thresholds and apply the correct tax rules and rates to your sales once you are registered.

Validate buyer tax IDs across the globe

Validate buyer or supplier tax IDs across the globe through a simple user interface or API integration.

Explore Lookup

Automatically calculate VAT

Automatically calculate VAT/GST based on liable entity, region, and content type.

Explore Tax

Global e-invoicing

Produce locally compliant invoices and e-invoices anywhere you need to.

Explore E-invoicing

Sell in any market without the risk

Why you should choose Fonoa?

- Become globally compliant in a matter of days with low-code, flexibleAPIs.

- Comply with local rules instantly with out-of-the-box tax logic.

Stay tax compliant in every step of your creativity

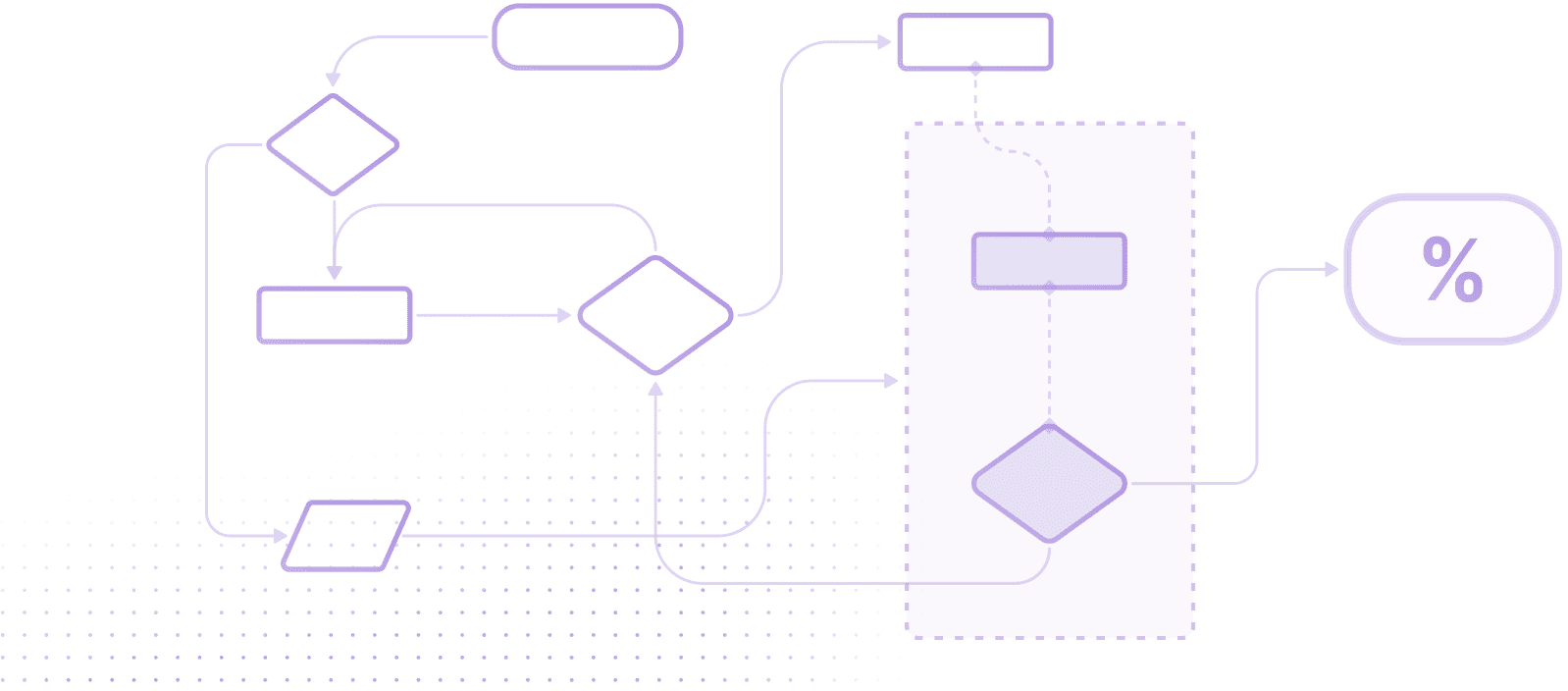

Keep track of complex content rules

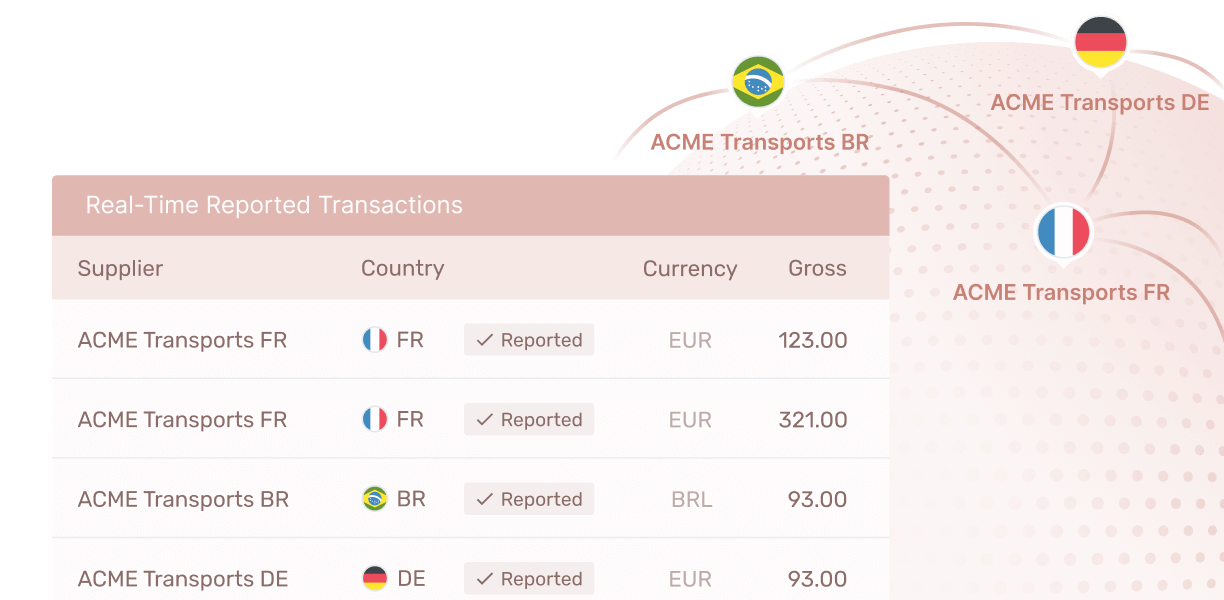

Local tax regulations vary greatly, with different rules for live vs. pre-recorded content, specific formats, or transactions between creators. Fonoa’s tax engine is always updated, automatically calculating the correct VAT/GST, or sales tax as transactions take place.

Charge tax for live events and creator content the right way

Changing tax laws add complexity to live events and creator-led content. Fonoa tells you exactly when you’re liable for taxes as a supplier of virtual events, live-streams, and other complex situations so you can collect VAT upfront, avoid fines, and preserve your margins.