Global tax compliance for marketplaces

Automatically validate the tax status of marketplace sellers, determine the right tax rates for each transaction, invoice and report transactions according to local tax requirements.

Let's talkA solution designed by experts in the field

Our team has unique experience, having worked at and grown some of the world's largest marketplaces. That in-depth and specific knowledge has helped us design solutions specific to global marketplaces and platforms.

Validate buyer's tax ID

Validate buyer and supplier tax IDs across the globe with a single API.

Explore Lookup

Tax determination for any transaction

Determine the right sales tax, VAT and GST treatment for all your marketplace and third-party transactions globally.

Explore Tax

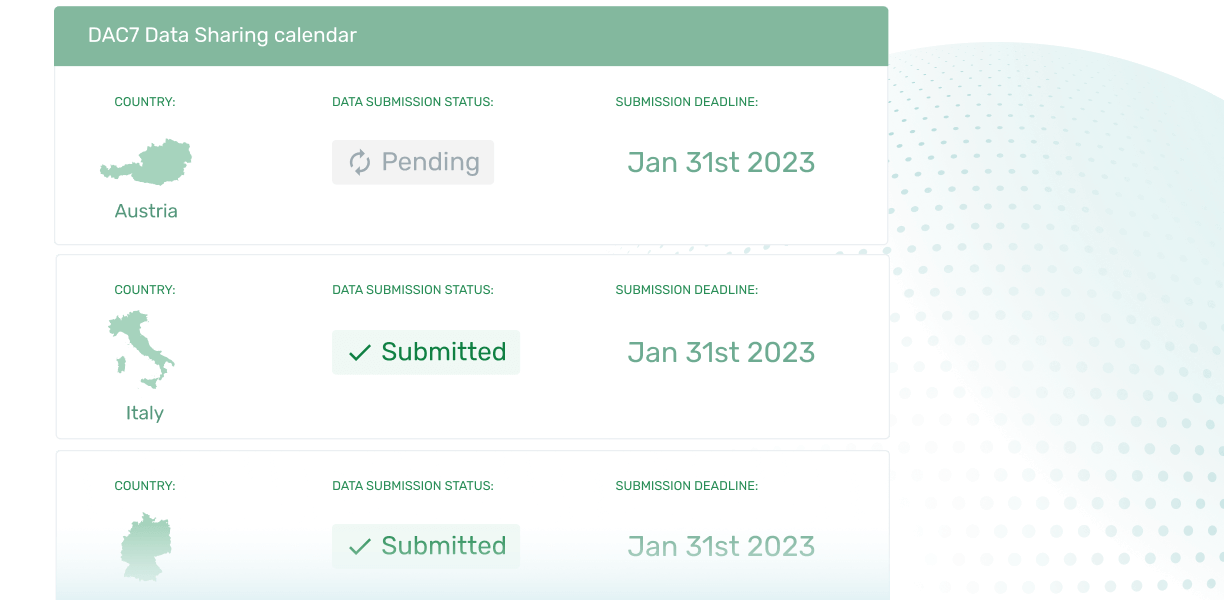

Secure and compliant data sharing

Meet quickly evolving data sharing laws and securely share tax data with authorities across countries.

Explore Data sharing

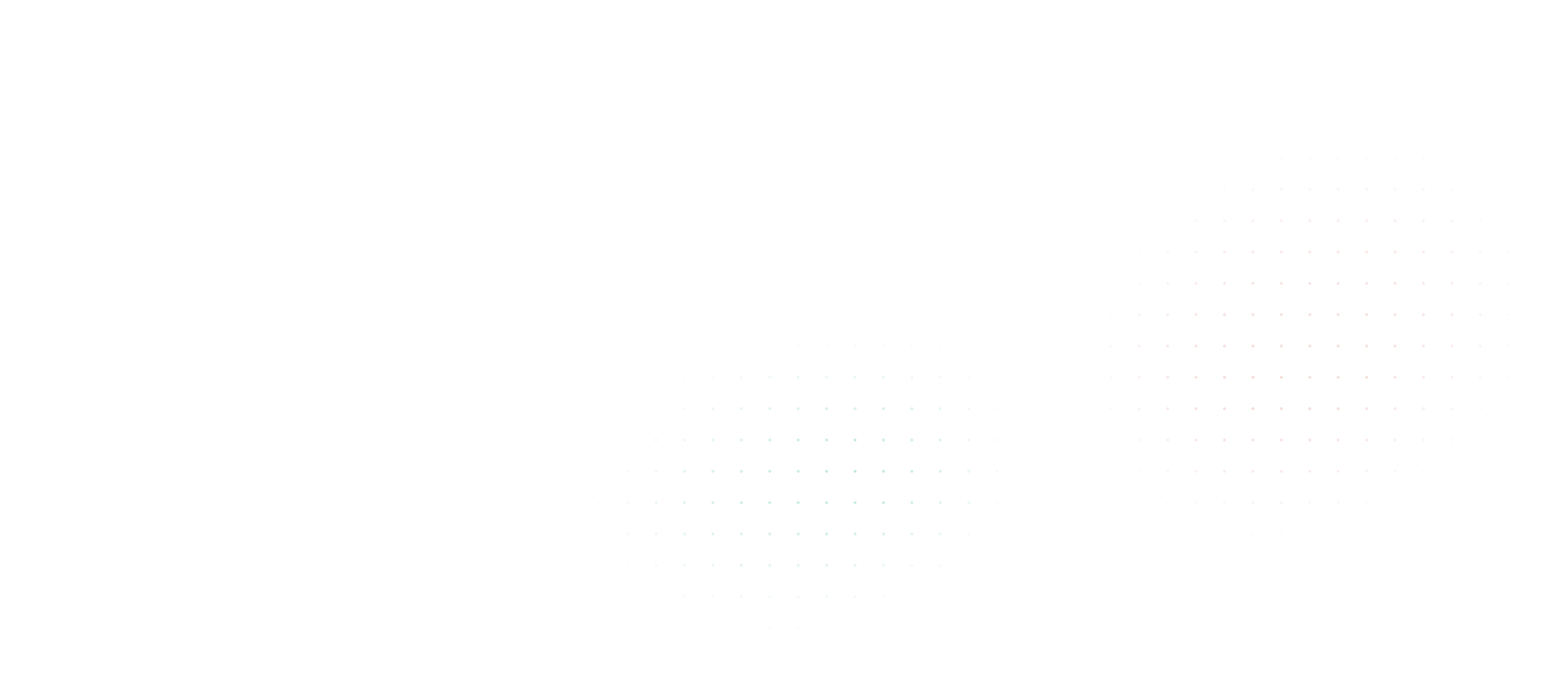

Comply with invoicing and documentation rules

Issue invoices and e-invoices in the right language and format automatically from a single platform, for your customers and on behalf of your marketplace sellers.

Support for

- Receipts

- Self-billing

- Summary invoices

- Credit notes

- 3rd party billing

- Transportation documents

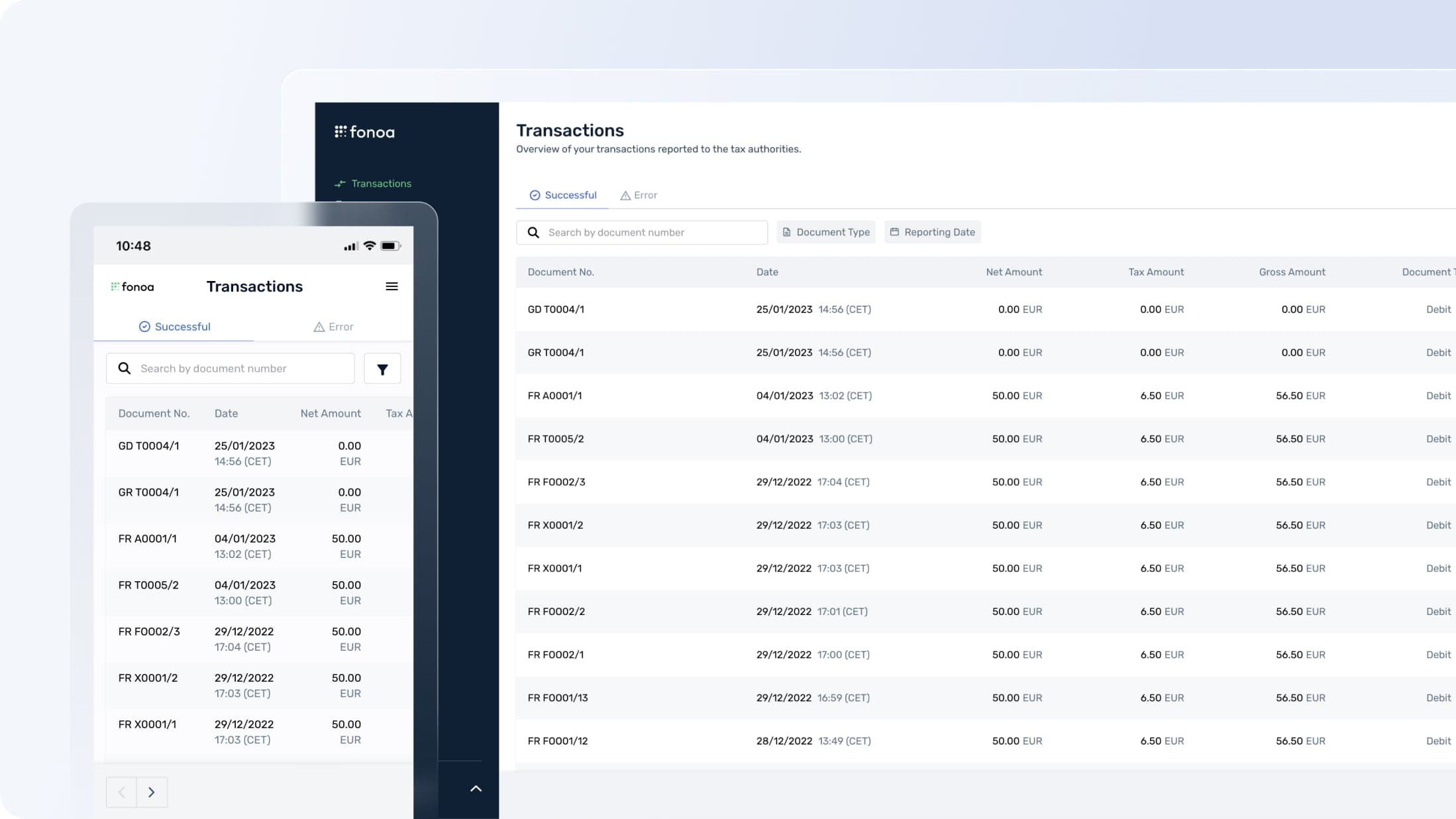

Keep suppliers compliant and informed

Empower marketplace sellers to generate e-invoices and report transactions electronically with Fonoa’s third-party supplier portal.

- Access transaction data quickly and easily for investigations, ad-hoc requests and audits.

- Filter transactions by criteria for tax, documents, reporting and returns and more.

- Stay compliant with marketplace rules across countries.