E-invoicing Explained: 🇷🇴 Romania

Demystify e-invoicing in Romania: Understand requirements and solution selection. Join us now!

Interested in unlocking the potential of e-invoicing in Romania?

Join us for an in-depth live session, where we'll guide you through every aspect of implementing e-invoicing in your business. Recognize that e-invoicing goes beyond mere compliance—it's about thriving in a dynamic business landscape. Acquiring a deep understanding of its nuances is pivotal for not only meeting regulatory requirements but also for optimizing your operational efficiency.

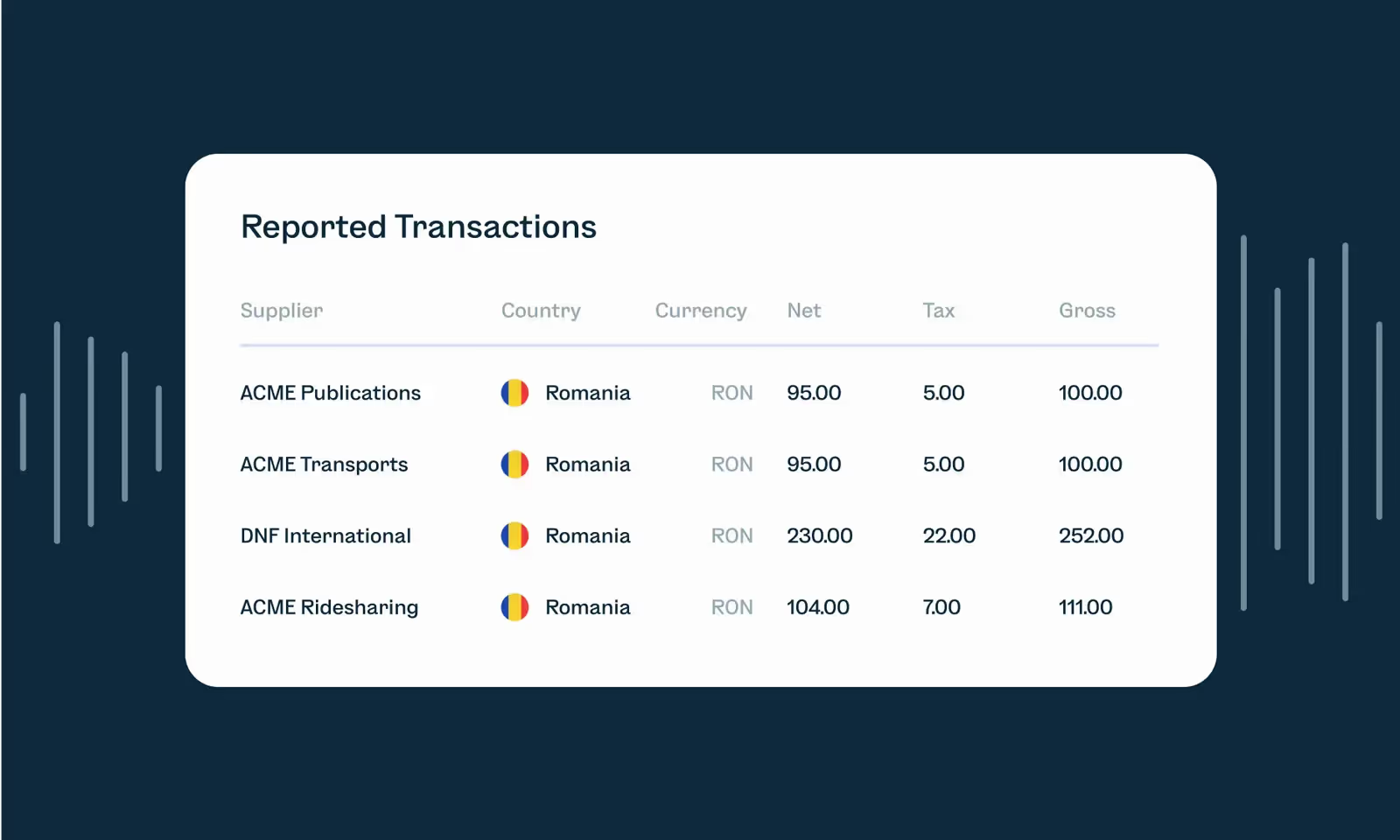

In the opening segment, we'll delve into the unique requirements of e-invoicing implementation in Romania. From deciphering the regulatory framework to simplifying the process of generating e-invoices, we've got you covered.

Contemplating the adoption of an e-invoicing solution but feeling uncertain about where to begin? Uncover expert insights on selecting the ideal solution tailored to your business needs and the critical factors to consider along the journey.

Agenda

- E-Invoicing Requirements in Romania: Understanding the requirements and specific challenges with e-invoicing in Romania

- Implementing an e-invoicing solution in Romania: Selecting the right solution for your business and key considerations when choosing a solution

- Q&A

Don't let the complexities of e-invoicing hold you back. Seize this opportunity to gain valuable insights and actionable strategies.