You've built a solid case for tax automation. You know the pain points, you've mapped the impact, you're ready to pitch.

Then your CFO asks: "What does engineering think about this? Have you talked to finance?"

If you haven't, you're walking into that meeting without backup. And your proposal just got a lot harder to approve.

Tax automation isn't just a win for the tax team. The strongest business cases demonstrate value across functions. Before you pitch leadership, you need buy-in from the teams who'll be affected—and whose support your CFO will want to see.

Why cross-functional alignment matters

Tax automation touches multiple teams. Engineering will need to integrate it. Finance will need to work with the data. Product may need to adjust workflows.

If those teams see your proposal as "tax's project that creates work for us," you'll face resistance. If they see it as something that solves their problems too, you'll have advocates.

More practically: your CFO will check with these stakeholders before approving budget. Getting alignment early means you control the narrative. You're not waiting to see what objections surface—you've already addressed them.

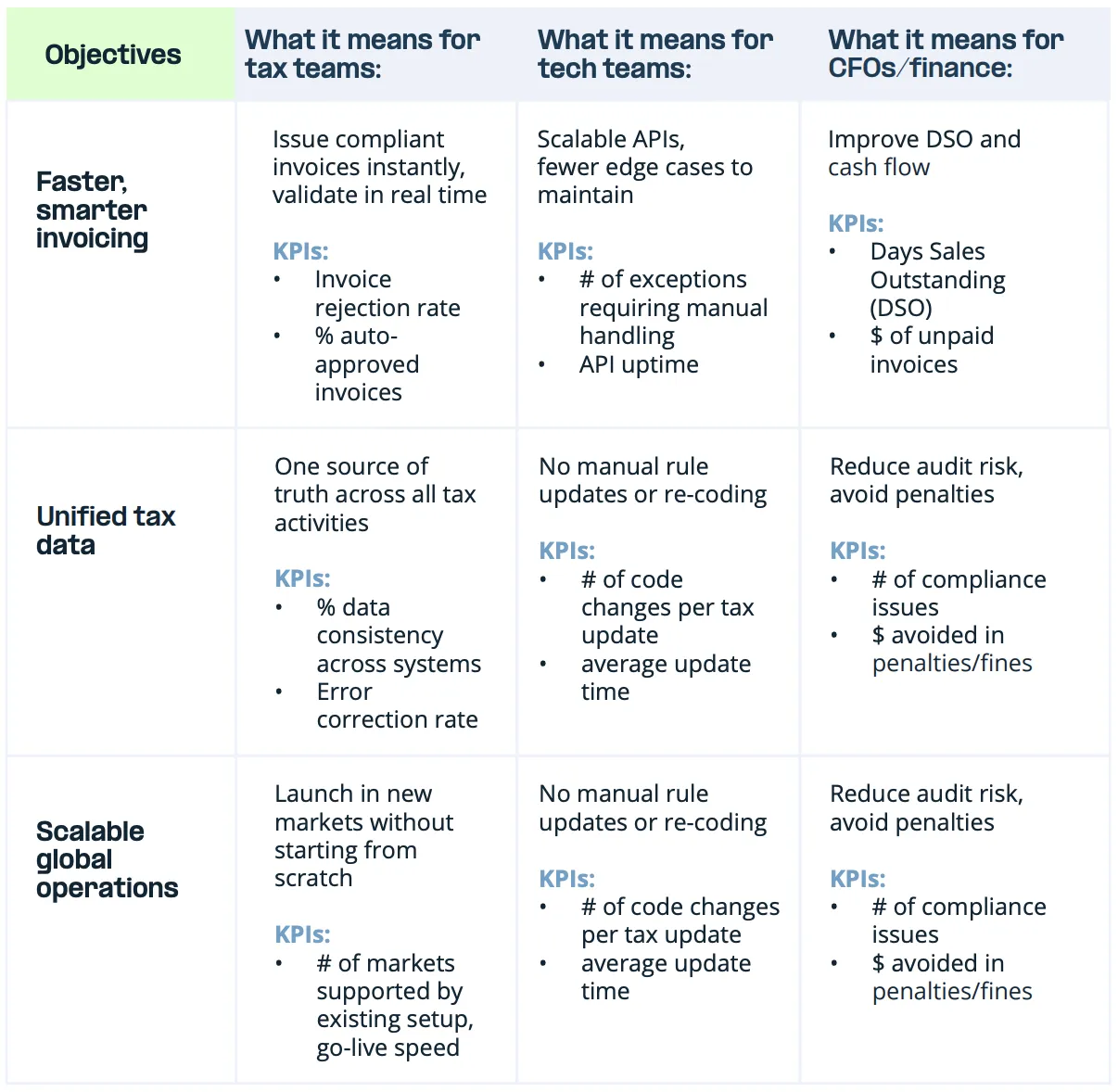

What each team cares about

The same automation benefit means different things to different people. Here's how to translate.

For tax teams

Primary concerns: Reducing manual work, staying compliant with changing regulations, having reliable data for filings.

What they want to hear:

- Reduction in manual reconciliation and data entry

- Real-time compliance that keeps pace with regulatory changes

- Fewer errors and less time spent on corrections

KPIs that resonate: Percentage reduction in manual tasks, number of FTEs that can be reallocated to higher-value work, percentage of filings submitted on time without intervention.

For engineering and product teams

Primary concerns: Minimizing support burden, avoiding ongoing maintenance, keeping systems simple and scalable.

What they want to hear:

- Fewer tax-related support tickets

- No need to manually update rules when regulations change

- Clean APIs that handle edge cases without custom code

KPIs that resonate: Number of tax-related support tickets, time spent on maintenance, number of code changes required per tax update, API uptime and reliability.

For finance and the CFO

Primary concerns: Controlling costs, reducing risk, improving cash flow predictability.

What they want to hear:

- FTE savings or reallocation as volume scales

- Lower audit exposure and penalty risk

- Faster invoicing that improves DSO

KPIs that resonate: Cost per transaction, dollars saved from headcount efficiency, compliance issues avoided, Days Sales Outstanding improvement.

How to build alignment

1. Have the conversations early

Don't wait until you're ready to present. Talk to engineering, finance, and product leads while you're still building your case. Ask what their pain points are. Ask what would make them supportive.

You'll often discover angles you hadn't considered. Maybe engineering is already frustrated with maintaining tax logic. Maybe finance has flagged invoicing delays as a problem. Those become part of your story.

2. Speak their language

When you meet with engineering, don't lead with compliance requirements. Lead with reduced maintenance burden and cleaner architecture.

When you meet with finance, don't lead with tax accuracy. Lead with cost control and cash flow.

Same project, different framing. Tailor the message to what each audience cares about.

3. Quantify the cross-functional impact

If you can say "this will reduce tax-related support tickets by 40%" or "this eliminates the need to hire two additional engineers as we scale," you've given those teams a stake in the outcome.

Work with each function to identify metrics they track. Then show how automation moves those numbers.

4. Bring them into the proposal

When you present to leadership, reference the conversations you've had. "I've discussed this with the engineering lead, and they estimate it would save X hours per month in maintenance." "Finance has flagged that our current invoice rejection rate is costing us Y days in DSO."

This signals that you've done your homework—and that approval won't trigger a wave of objections from other teams.

The payoff

Cross-functional alignment takes time upfront. But it dramatically increases your chances of approval.

When your CFO sees that engineering, finance, and product are all supportive—that this isn't just a tax initiative but a business initiative—the decision gets easier. You've de-risked the proposal before it even reaches the table.

Build your coalition first. Then make your pitch.

Need help mapping stakeholder value? We work with cross-functional teams to build aligned business cases. Let's talk.